Understanding the 2025 Social Security COLA Increase

The Social Security Cost-of-Living Adjustment (COLA) is an annual increase designed to protect the purchasing power of Social Security benefits against inflation. This increase is determined by the change in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) from the third quarter of the preceding year to the third quarter of the current year.

Factors Determining the Social Security COLA Increase

The COLA increase is calculated using a formula that considers the change in the CPI-W over a specific period.

The formula for calculating the COLA is:

(CPI-W for the third quarter of the current year) – (CPI-W for the third quarter of the preceding year) / (CPI-W for the third quarter of the preceding year) x 100 = COLA percentage

For example, if the CPI-W for the third quarter of 2024 is 300 and the CPI-W for the third quarter of 2023 was 290, the COLA increase would be calculated as follows:

(300 – 290) / 290 x 100 = 3.45%.

This means that Social Security benefits would increase by 3.45% in 2025.

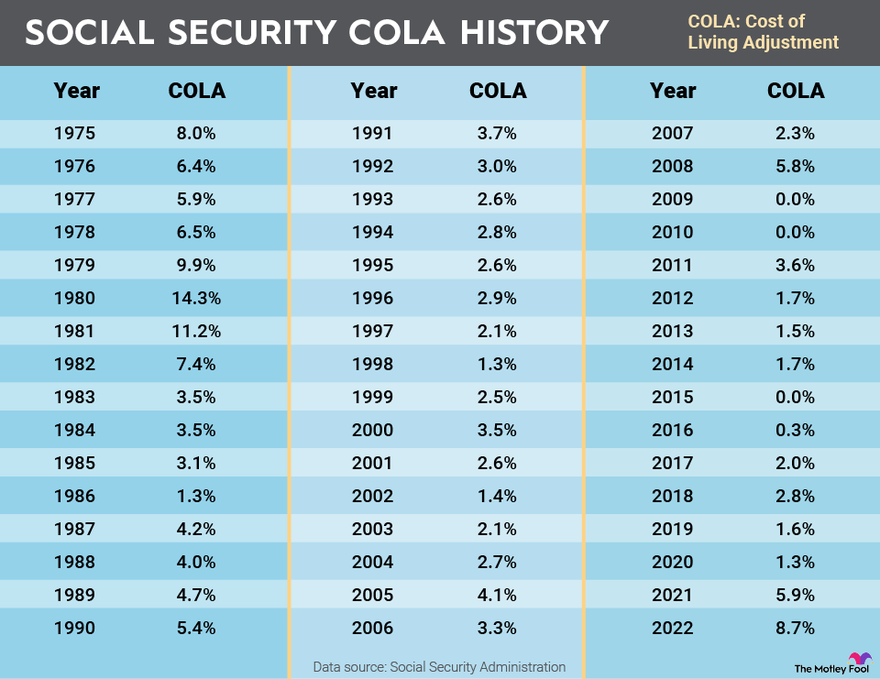

Historical Overview of Recent COLA Increases, 2025 social security cola increase

The COLA increase is adjusted annually based on inflation. Here is a table outlining recent COLA increases and their impact on beneficiaries:

| Year | COLA Increase | Impact on Beneficiaries |

|---|---|---|

| 2023 | 8.7% | The 8.7% COLA increase in 2023 was the largest increase in over 40 years. This increase provided much-needed relief to beneficiaries struggling with rising inflation. |

| 2022 | 5.9% | The 5.9% COLA increase in 2022 helped to offset rising inflation, providing a much-needed boost to the purchasing power of Social Security benefits. |

| 2021 | 1.3% | The 1.3% COLA increase in 2021 was the smallest increase in decades. This was due to the relatively low inflation rate in 2020. |

Projected 2025 COLA Increase Based on Current Economic Indicators

While the exact COLA increase for 2025 will not be known until later in the year, current economic indicators suggest that the increase could be significant. Inflation has been relatively high in recent months, and economists expect it to remain elevated for the remainder of 2024. This suggests that the 2025 COLA increase could be higher than the 2023 increase.

Impact of the 2025 COLA Increase on Beneficiaries

The 2025 Social Security COLA increase is designed to help beneficiaries maintain their purchasing power amidst inflation. However, the impact of this increase will vary depending on the individual beneficiary’s circumstances.

Impact on Different Beneficiary Groups

The COLA increase will benefit all Social Security beneficiaries, including retirees, disabled individuals, and survivors. The specific impact will depend on the individual’s benefit amount and their personal financial situation.

Retirees

The COLA increase will help retirees maintain their standard of living by offsetting the rising cost of goods and services. For example, a retiree receiving a monthly benefit of $2,000 could see their benefit increase by $200 if the COLA is 10%. This additional income could help them cover expenses such as housing, healthcare, and utilities.

Disabled Individuals

The COLA increase will also provide much-needed financial support to disabled individuals. Many disabled individuals face significant expenses related to their disability, such as medical costs, assistive devices, and transportation. The COLA increase can help them cover these expenses and improve their quality of life.

Survivors

Survivors who rely on Social Security benefits will also benefit from the COLA increase. The increase can help them cover living expenses and ensure financial stability during a difficult time. For example, a widow receiving a monthly benefit of $1,500 could see her benefit increase by $150 if the COLA is 10%. This extra income could help her manage her household budget and maintain her standard of living.

Impact on Purchasing Power

The COLA increase aims to help beneficiaries maintain their purchasing power. However, the effectiveness of the increase will depend on the rate of inflation. If the COLA increase is less than the inflation rate, beneficiaries will experience a decline in their purchasing power.

For example, if the COLA is 3% and the inflation rate is 5%, beneficiaries will see a net decrease in their purchasing power of 2%. This means they will have less money to spend on goods and services than they did before the COLA increase.

Challenges and Limitations

While the COLA increase is intended to help beneficiaries, there are some challenges and limitations associated with it. One challenge is that the COLA is based on the Consumer Price Index (CPI), which may not accurately reflect the actual expenses faced by beneficiaries. For example, the CPI may not fully capture the rising costs of healthcare, housing, or transportation for seniors.

Another limitation is that the COLA is applied to all beneficiaries, regardless of their individual circumstances. This means that beneficiaries with higher incomes may receive a larger dollar increase, even though they may not need it as much as beneficiaries with lower incomes.

Furthermore, the COLA increase may not be sufficient to offset the rising costs of living for all beneficiaries. Some beneficiaries may still struggle to make ends meet, even with the COLA increase.

Implications for the Social Security System: 2025 Social Security Cola Increase

The 2025 COLA increase, while a boon for beneficiaries, presents a significant challenge for the long-term financial sustainability of the Social Security system. The system’s trust fund is projected to be depleted by 2034, meaning that without changes, benefits would have to be cut by approximately 20%. This upcoming COLA increase will undoubtedly exacerbate the existing financial strain on the system.

Projected Cost of the COLA Increase

The cost of the 2025 COLA increase will be significant, adding billions of dollars to the annual Social Security budget. The exact cost will depend on the final COLA percentage, but it is expected to be substantial, considering the projected inflation rate.

Potential Policy Implications

The 2025 COLA increase necessitates a critical examination of potential policy implications and adjustments to ensure the long-term solvency of the Social Security system. Several policy options are being discussed, including:

- Increasing the retirement age: Raising the full retirement age, currently 67 for those born in 1960 or later, would delay benefit payments and extend the time period over which Social Security taxes are collected.

- Reducing benefits: Adjusting benefit formulas, such as reducing the amount of benefits paid, could help slow the rate of spending growth. However, this option would be politically challenging and could disproportionately affect lower-income beneficiaries.

- Raising payroll taxes: Increasing the payroll tax rate or the taxable wage base could generate additional revenue to offset the increasing costs of benefits. This option could be less politically palatable than other options, as it would require higher taxes on workers.

- Investing trust fund reserves: Exploring alternative investment strategies for the trust fund reserves could potentially generate higher returns and help offset the increasing costs of benefits. However, this option would require careful consideration of risk and potential for losses.

2025 social security cola increase – The 2025 Social Security cost-of-living adjustment (COLA) is a significant factor for millions of Americans, particularly those relying on these benefits for their livelihood. However, global events, such as the recent Iran attack , can impact the economic landscape and, in turn, influence the COLA calculation.

The final percentage increase will depend on a complex interplay of factors, including inflation and economic growth, making it difficult to predict with certainty.

The 2025 Social Security cost-of-living adjustment (COLA) is a significant factor for millions of Americans, and its determination relies on a complex set of economic indicators. While the COLA is calculated based on data within the United States, it’s interesting to note that the current time in Israel, which can be found here , might be a factor in global market trends that ultimately influence the COLA calculation.